State of the EUnion: Blockchain technology

On Sept 15, the European Commission delivered its annual “State of the Union” speech. Between discussions over vaccination, climate finance and fairer working conditions, President Ursula von der Leyen divulged the Commission's plan for economic sovereignty: A Path to the Digital Decade.

This path includes concrete objectives that the Commission aims to reach by 2030. Among them: At least 80 percent of the population should have basic digital skills, 75 percent of EU companies should use the Cloud/AI/Big Data, and key public services should be 100 percent online.

To reach these goals, European countries must better collaborate on data infrastructure, low-power processors, 5G, high-performance computing, secure quantum communication, public administration, blockchain services, digital innovation, and investing in people’s digital skills. According to von der Leyen, about one-fifth of the EU’s €750B ($887 billion) pandemic recovery fund will be allocated to these efforts.

Let’s dive deeper into the current state of the blockchain technology market.

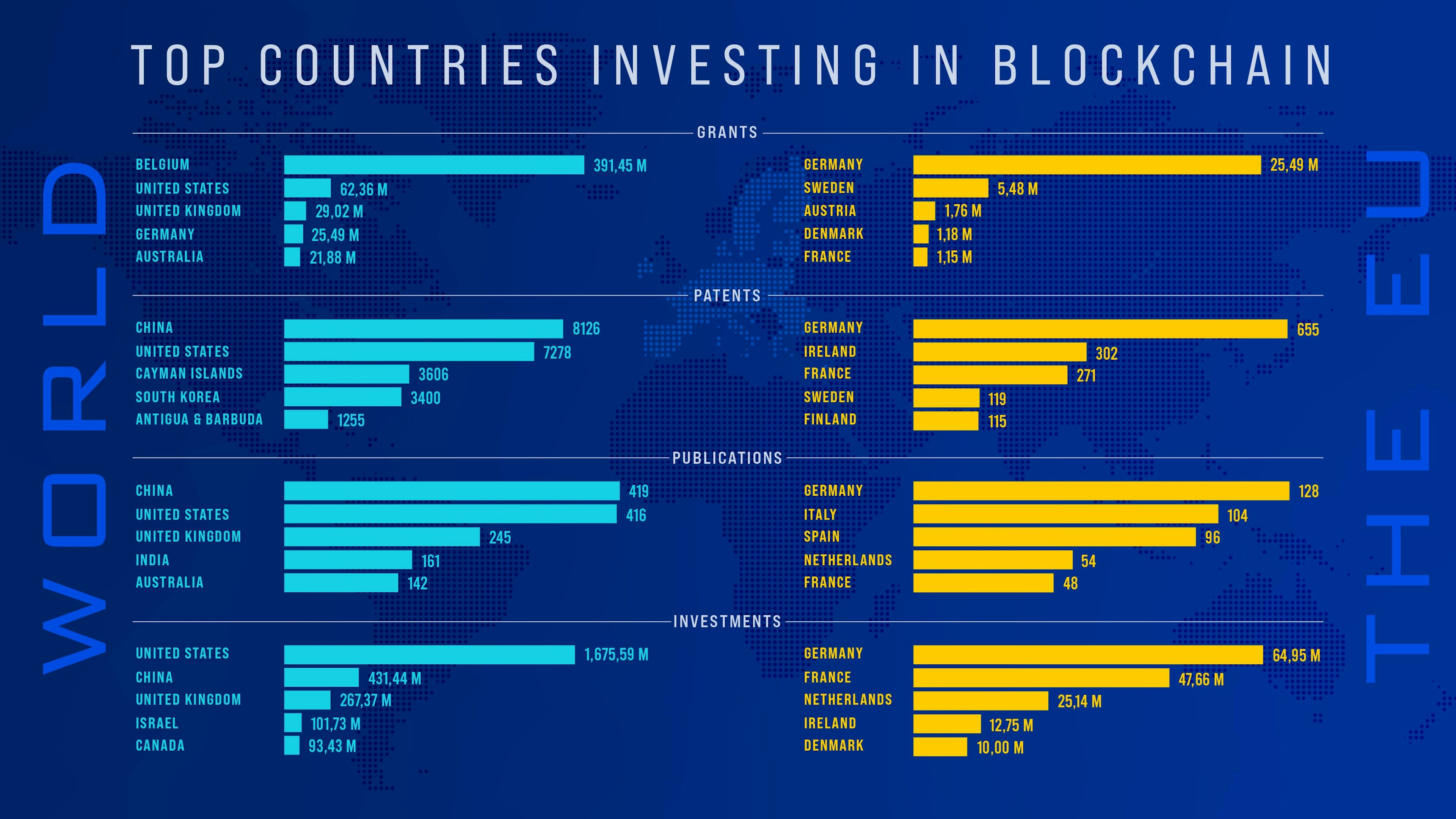

According to L’Atelier’s technology intelligence engine, the European Commission, through Brussels, has been the highest investor in blockchain initiatives via grants since 2016. It spends almost six times the US budget for the same technologies.

Blockchain R&D (world and EU). Source: L'Atelier's technology intelligence engine.

But when we take a look at private investment and R&D development (number of patents and publications), China and the United States remain leaders. Third place goes to the United Kingdom.

Blockchain leaders in the European Union

Germany follows the UK in the rankings—no surprise, as German regulations on crypto are favourable at the moment, especially in terms of taxation.

It is followed by France, which has been openly vocal in its support of the technology since 2016, and has designed work groups and regulations accordingly.

Who invests in what?

In terms of grants, the US mainly issues them through defence entities, with a focus on data management and cybersecurity. Investments mainly go toward digital asset management firms.

Blockchain Top Grants & Investments (US). Source: L'Atelier's technology intelligence engine.

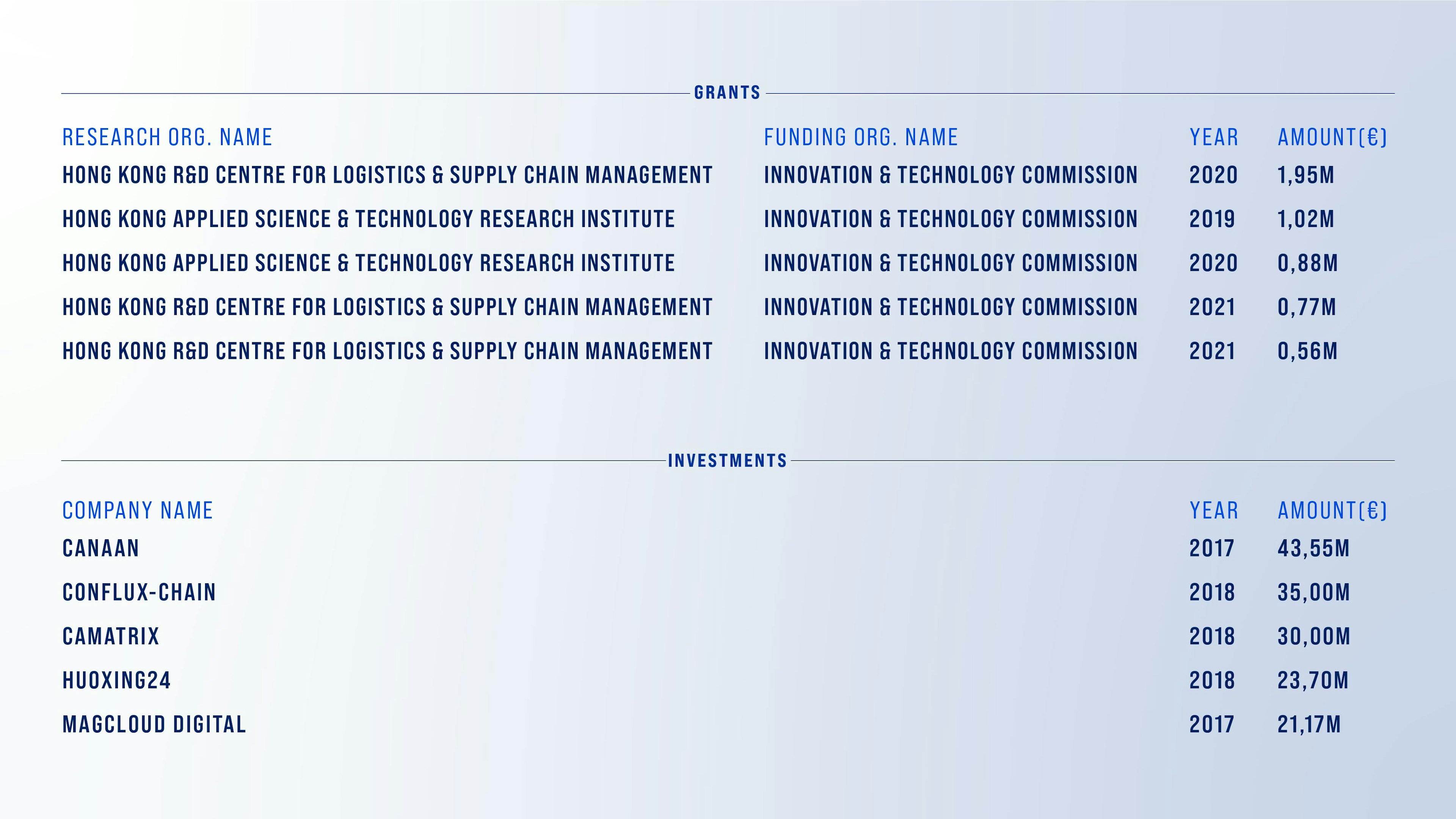

China—the world’s largest exporter of goods and services—primarily issues blockchain development grants to supply chain solutions providers. Investments are otherwise mostly dedicated to blockchain infrastructure: Hardware, multi-chain, flux management, etc.

Blockchain Top Grants & Investments (China). Source: L'Atelier's technology intelligence engine.

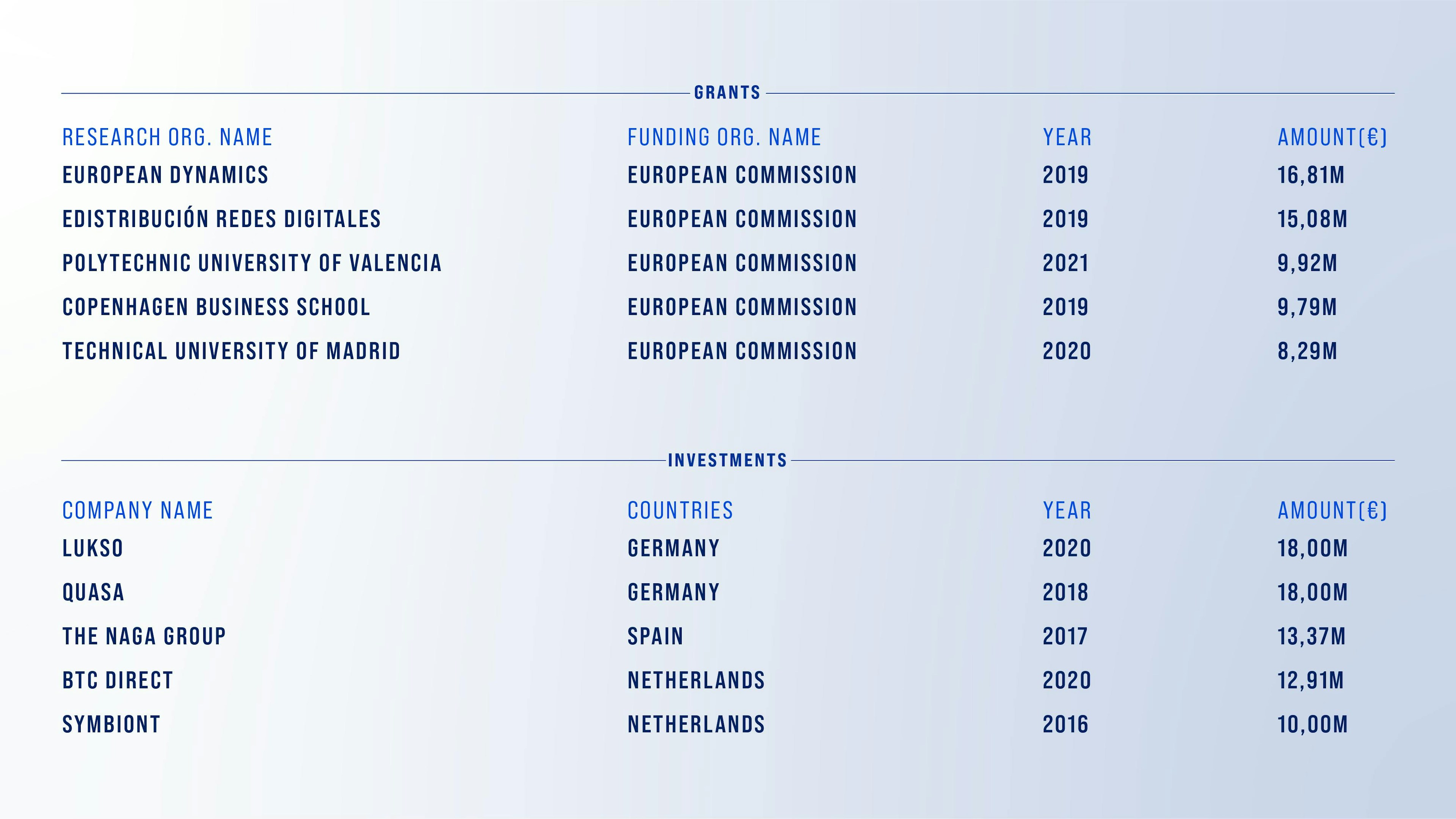

According to our engine, members of the European Union are actually already aligned to the objectives set by the European Commission, at least from a grants perspective.

Digitisation of company processes, electricity distribution, and data management for public institutions are the major focus of projects that received investment over the last three years. Investments are mainly dedicated to asset management and digital identities.

Blockchain Top Grants & Investments (EU). Source: L'Atelier's technology intelligence engine.

Insights

Three investments signal the EU’s interest in a blockchain-powered virtual economy:

- Lukso—a startup developing blockchain protocols and infrastructure for what they call a “multiverse.” It has been among the EU’s most-funded startups in the last 5 years. Its technology enables the creation of “universal public profiles” (digital identities), as well as solutions for physical and digital consumer goods. Lukso plans to develop its own virtual economy platform, and has already partnered with digital fashion brands.

- Marble.cards. The highest investment for Sweden in 2021 was for this NFT creation and trading game, enabling users to turn a web page into a unique digital card.

- Arianee—where French investors are placing their bets. France being the “fashion capital of the world,” this startup uses blockchain technology to allow big fashion and luxury brands to enter the virtual economy realm. Arianee provides virtual authentication services, NFTs or digital twins to the industry.

- Bonus! It’s worth noting that, in 2019, the US also invested in Rally.io, a blockchain company enabling independent creators (artists, celebrities, influencers, etc.) to monetise content through NFTs and social tokens (a novel type of digital asset).

The is part one of our series on technologies the EU Commission has prioritised on its “Path to the Digital Decade.”

The data from this article is powered by L’Atelier’s technology intelligence engine. This engine conducts deep quantitative analysis of large distributed datasets related to technology. To learn more, please reach out.

14 Dec 2021

-

Aurore Geraud

Illustrations by Debarpan Das.

Stay one step ahead of the future with our weekly newsletter.

02/03

Related Insights

03/03

L’Atelier is a data intelligence company based in Paris.

We use advanced machine learning and generative AI to identify emerging technologies and analyse their impact on countries, companies, and capital.