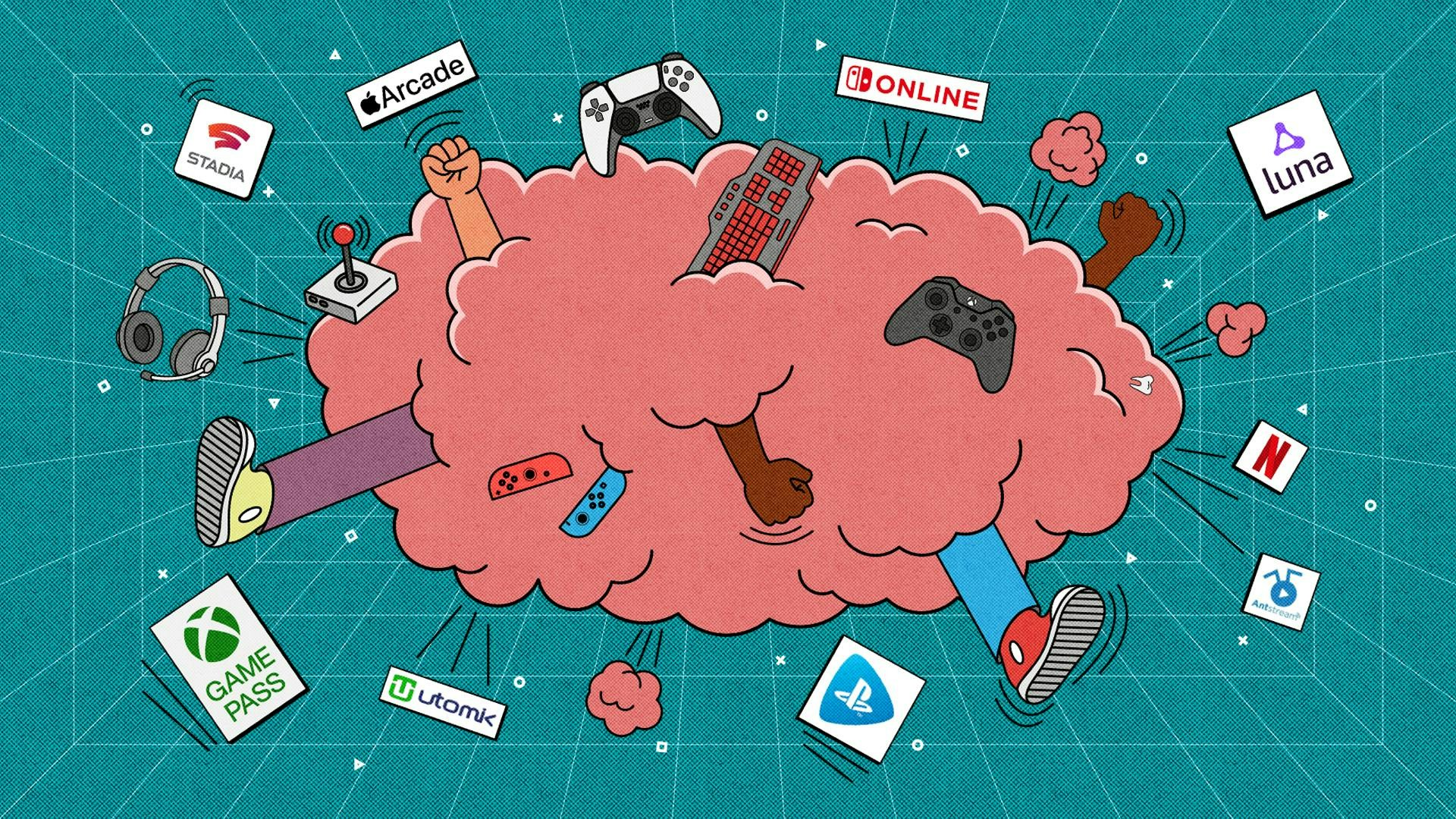

The ‘Netflix of Games’: Predicting what's ahead

Who will be the ‘Netflix of Games’? Earlier this week, we looked at the contenders in the arena. Now, we consider how the battle will truly bear out.

As the subscription-based future of gaming catches up with the present, it merits asking how the transition might affect companies that actually make the games. In a February 2021 investigation, Eurogamer found that, perhaps surprisingly, publishers are generally positive about adding their games to Xbox Game Pass, though it might mean missing out on individual sales.

It’s a point echoed by Mike Rose, director of indie-game publisher No More Robots. “The impact from my perspective is ‘great in the short term, potentially bad in the long term’,” he says. “By that I mean, currently all of these platforms need to throw decent money at developers and publishers to get them onboard with their service, which can completely remove all the risk from the development of a game, and mean you go into your launch already at a break-even. But as time goes on, if one or two services balloon above the others, and by that point don't actually need to throw so [much] money at you anymore—i.e. devs need the platforms more than the platforms need the devs—that could potentially cause problems.”

Rose continues, “For now though, it seems like a win-win for everyone really—the platforms, the devs, the publishers, the players. We just have to hope that the competition gets fierce, and platforms need to continue paying out real money to the creators!”

The removal of risk for developers could encourage more experimentation. If companies know they’re getting a guaranteed upfront fee, rather than hoping to sell a certain number of units, they might feel more inclined to be more creative with their games. And the companies running the subscription service, for their part, are likely to want a broad range of genres on their platforms, to attract a wide range of subscribers.

Then again, if publishers are paid a bonus for the number of hours played on a subscription service, they might want to focus on certain genres that encourage maximum play time, like loot shooters or multiplayer games, rather than shorter, story-led experiences.

What the future holds

For the near future at least, downloading games is likely to remain preferable to streaming for subscription service users. Even on PlayStation Now, which originally launched as a streaming-only service, the majority of users prefer to download games, according to Sony’s March 2021 report. The patchy nature of broadband networks worldwide means reliable streaming could be unattainable for subscribers in remote or heavily congested areas, so downloading games (slowly) could be their only option if they register for a subscription service.

That may change over the next decade, as hyper-fast broadband reaches more cities, and 5G mobile networks roll out across the globe. As game streaming becomes more feasible and reliable for more users, platforms that offer a choice between downloading games and streaming them—like Xbox Game Pass Ultimate—will be poised to spearhead the transition.

This move to streaming will also mean expensive consoles no longer need be part of the equation, so companies can potentially reach users who perhaps wouldn’t normally buy a console. James Batchelor, editor-in-chief of Gamesindustry.biz, thinks Xbox Game Pass is well placed in this regard: “If the cloud gaming on mobile and in browsers overcomes the lag and technical difficulties all game-streaming services encounter, it will unlock untapped but lucrative markets for Microsoft, like India and China.”

Let’s not forget Amazon, with its enormous financial clout and world-leading cloud infrastructure. If the tech giant focuses its ambitions on the video-gaming sector—it is allegedly already spending nearly $500 million a year on its video game division—it could easily buy its way into dominance, snapping up publishers and developers as Microsoft did.

Over the next few years, as companies seek to secure more exclusive content for subscription services, the current trend for consolidation in the industry is set to continue. Sony’s acquisition of Destiny studio Bungie for $3,6 billion—less than two weeks after Microsoft announced it would buy Activision Blizzard for a record-breaking $68,7 billion—is a sign of things to come, as big players rapidly seek to steal away the industry’s crown-jewel developers for their own.

It will be interesting to see how Sony responds to Microsoft’s aggressive push for Game Pass, and whether the rumoured revamp of its own subscription service will match Microsoft’s efforts. One interesting possibility is a potential linkup between Sony and Google. When Stadia head Phil Harrison announced the closure of Stadia’s internal game studios, he stressed there was an opportunity “to work with partners seeking a gaming solution all built on Stadia’s advanced technical infrastructure and platform tools.”

Could Sony potentially be one such partner? An allegiance with Google could counter Microsoft’s lead in cloud computing, and avails the intriguing possibility of streaming PlayStation 5 games to mobile phones, tablets, and more.

Then again, the subscription-based future might topple the traditional titans of the games industry, just as Netflix usurped the old TV guard. “Ironically, because they're so linked with the past and have their own hardware and software publishing empires to manage, we could see Microsoft, Sony and Nintendo lose out in this particular battle to an entirely new rival,” thinks Damien McFerran, editorial director at Nintendo Life. “We might be looking at someone like Amazon or Valve stepping in and creating a service which flips the whole games market on its head.”

Will Valve take their dominant Steam platform into the subscription space? Will their bitter rival Epic launch a counter service? Or will we see an entirely new entrant, such as the Chinese mega-company Tencent, take the market by storm with their own version of a ‘Netflix for games’?

The possibilities are intriguing … and the battle is far from over.

11 Mar 2022

-

Lewis Packwood

Illustration by Debarpan Das.

Stay future-focused with our weekly newsletter.

02/03

Related Insights

03/03

L’Atelier is a data intelligence company based in Paris.

We use advanced machine learning and generative AI to identify emerging technologies and analyse their impact on countries, companies, and capital.