Small-scale solar could be one of energy’s big solutions. What’s stopping us?

TOPICS

EnvironmentMy garden shed is falling apart and I need to replace it. (Bear with me; this will all link back to solar power, I promise.) Replacing this modest structure will require somewhere between €600 and €1200, so let’s split the difference and say €850. What if I ripped it all down and built it back using just solar panels?

With a tape measure and some back-of-the-envelope maths, a roughly-equivalent surface area of JA Solar 440W half-cell modules (around €78 per panel at time of writing) would cost just shy of €655. Put simply, it would be cheaper to buy power generating, mono-crystalline miracles of modern energy and bolt them together over basic chipboard and panels.

This plummeting cost represents the most fundamental change in power generation and distribution since electricity grids were installed a little over a century ago. Solar panels can be produced in such quantity and at such low cost that it is now the cheapest form of power generation. They could solve not just renewable energy’s greatest shortcomings, but those of power generation globally, fundamentally transforming how we produce, store and consume power.

How solar became ridiculously, insanely cheap

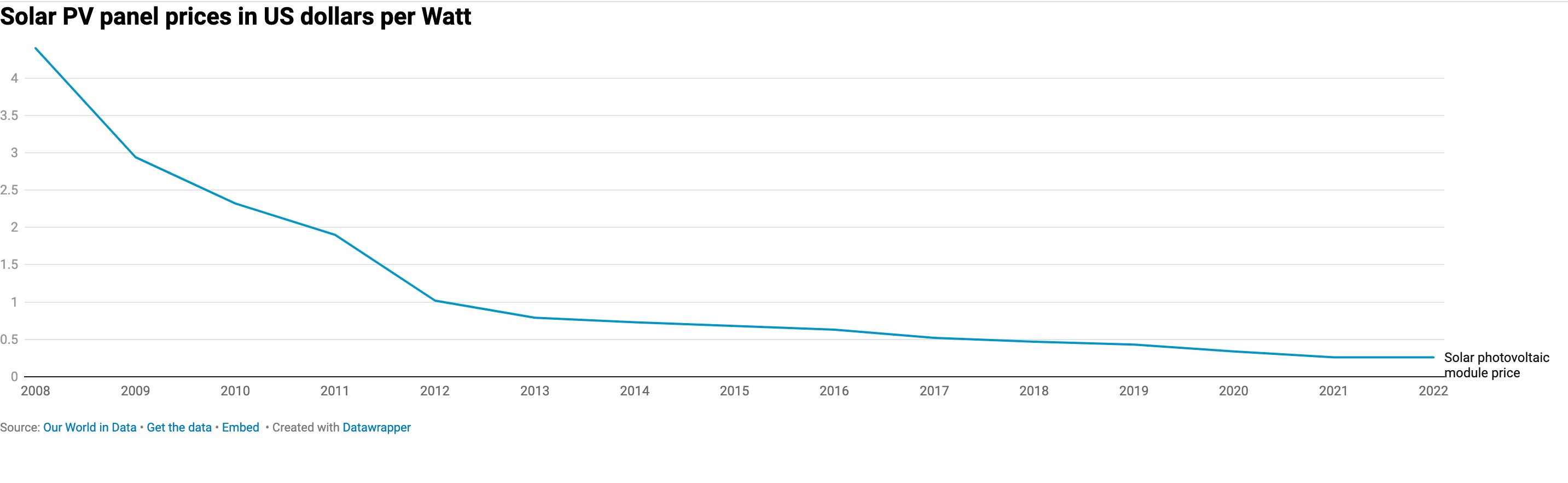

Every year since 2008 the price of solar power has fallen, declining 94 percent between then and 2022. Today a brand-new solar module made in China costs around $0.10 USD per watt according to Rystad Energy, compared to $4.40 per watt in 2008.

Courtesy of Datawrapper

Solar is, by and large, the world’s cheapest energy source. New solar photovoltaic (PV) installations have gone from being over four times as expensive (414 percent) over their lifetime than the cheapest fossil fuel equivalent in 2010, to half the cost (56 percent) in 2023, and are expected to get cheaper still, relative to fossil fuel energy sources, over the next decade. Between 2022 and 2023, the International Renewable Energy Agency (IRENA) estimated that the cost of a utility-scale solar project fell 12 percent.

That incredible shift is driven by the increasing efficiency of panels. Modern panels can convert a little over 20 percent of the light that hits them into energy compared to 15 percent a decade ago—but largely it is down to massive economies of scale.

To uncover how those came about, we must return to the years of the Subprime Crisis, specifically 2008.

As the global economy spiralled, even China wasn’t immune. Thus the Chinese government did what it does best at times of economic turbulence: it hit the stimulus button. A pillar of that spend was building up renewable production capacity, especially PV solar, part of a drive to shift Chinese manufacturing from less advanced categories and products. Consequently, PV solar benefitted from domestic consumption subsidies post-2008, but growth supercharged after its inclusion as a strategic industry in 2010, then integration into the CCP’s subsequent Five-Year Plan.

Productive capacity exploded, such that the economics of not just solar, but the entire energy sector, were altered.

In 2008 China produced 2,6 gigawatts (GW) annually. In 2009 it was in the region of 4GW; in 2010, 10,8GW. By the end of 2023, China had the capacity to manufacture a 861GW equivalent of solar panels per China Photovoltaic Industry Association data—a rise of 34,000 percent since 2008!

Power to the people

That production power is not just enormous; it dwarfs the current market for installations, meaning there is a major glut in PV solar, with global annual production more than double the levels of possible installations. This changes the economics of power generation dramatically, especially for those operating at less-than-utility scale.

Small-scale solar, also known as distributed solar, involves the kind of installations that you might see on a house roof and are currently only a comparatively small part of deployments. But the shifting price point of solar has made purchasing a solar system more attractive, especially as what consumers can electrify expands dramatically.

While a typical household in Germany may use something in the region of 5.000 kilowatt hours (kWh) per year, or roughly 13-14 kWh per day, most vehicles in the country are diesel- or petrol-powered and the vast majority of domestic heating is done via gas boilers. Both must shift towards heat pumps and electric vehicles (EVs) if Germany hopes to meet emissions targets. Combined, these would typically add between 6-10 kWh per day for EV charging and 7-12kWh for a heat pump, effectively doubling daily electricity requirements.

Having such large and electricity-intensive systems makes a solar array substantially more economically viable for many households in high-income countries.

However, the biggest change will occur in the global south. Here electricity grids can have numerous issues, from connectivity to affordability to repeated brownouts and blackouts. That makes small-scale solar even more competitive for these communities, empowering them to gain control over systems and their reliability.

In the west, retrofit “solar and battery in isolation is a difficult sell for a customer in a non-funded space,” says Richie Atkinson, E.ON Next’s Head of Future Energy Homes. But in the global south, even a relatively minuscule array capable of producing a few hundred watts, or one kilowatt per hour, can make a huge difference to villages without reliable power, especially as populations are largely concentrated in areas of high solar potential.

For a provocative illustration of this potential in action, pre Taliban-led Afghanistan provides a striking example of the economic and empowerment solar can offer. A 2020 paper on the country found that local farmers could transform agricultural productivity via solar-powered ground wells to the extent that the changes were clearly visible from satellite imagery. Within half a decade, the number of water reservoirs in Farah, Helmand, Kandahar and Nimroz provinces went from 182 to as many as 67.000 by 2019, driven almost entirely by the underlying economics of solar power.

Admittedly, much of this growth was driven by the need to water poppies for opium, and the effects on the local water table is highly problematic. But it nonetheless shows how even low-income, highly-remote locations can rapidly leverage solar power; indeed, they might be the ideal locations, considering the price of a solar module has more than halved since this study concluded.

Transforming a connectivity problem

Distributed power does just what it says: it distributes power generation capacity. This helps solve another critical problem with renewables and grids more generally—that of transmission.

For many countries there is a huge bottleneck in the infrastructure required to get clean power from where it is, or could be, generated to where it is consumed. In my home country of the UK, the grid was built to get power from nearby coal and gas fields to population centres, leaving a legacy of power lines and transformers poorly situated for emerging power such as wind.

As noted above, the problem of imbalanced grids becomes even more acute if large-scale electrification of heating systems is required, such as for countries like Germany, Italy or the UK, and for the widespread adoption of EVs. These require more power to be transmitted from large production centres to households in the current model, putting an additional layer of emphasis on updating older infrastructure.

The cost to push past this problem without looking at small-scale energy production is high, and the world is currently underinvesting in supporting renewable transmission. The UK’s National Grid, in charge of power infrastructure and transmission, is planning a £54 billion investment to meet 2035 decarbonisation goals, while forecasting demand to grow 64 percent over that timeframe. The IEA found, in its World Energy Outlook 2024, that each dollar spent on renewables is matched by only 60 cents of spend on storage and grids.

Therefore, putting power generation literally on top, or next to where it is required, is an obvious way to mitigate issues.

But this potential only truly unlocks with the addition of battery power to PV solar systems. E.ON’s Atkinson estimates that in the year-to-date “99 percent on 95 percent” of accredited installation by his firm “have been done with a battery system because that enables the customer to then manage their usage around their generation,” so rather than shunting excess power back to the grid, batteries can instead store power and maximise system efficiency.

Similarly to panels, batteries plummeting in cost, falling 82 percent from 2013 to 2023 according to Bloomberg New Energy Finance (BNEF). Atkinson notes that “the cost difference to the customer of a solar system, versus a solar and battery system” is only “something like a 10 percent difference in your price … because the 95 percent of the work that enables your battery to be installed is done by your solar installers,” meaning this critical step is now the most logical for most consumers in high-income countries.

What’s holding small-scale solar back?

To return to my own infrastructural peccadillos, I could potentially charge my car and heat my home for free with an abundant, supremely cheap energy source that was almost unimaginable even a decade ago. What’s stopping us all from having a solar array?

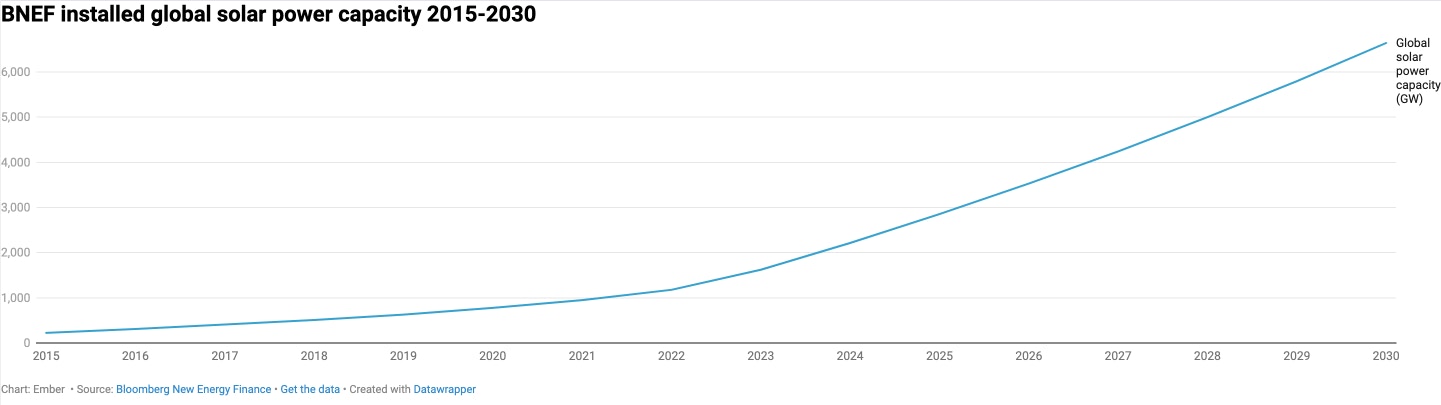

First, it is important to note that solar adoption is rising exponentially, just not as fast as production capacity is expanding. In 2024, BNEF estimates nearly 600GW will be installed, bringing total potential PV solar power capacity to 2,213 GW. To lend perspective to this number, peak demand in a relatively large western European country like France, Italy or the UK is generally around 40-55 GW, so this is still a huge figure. BNEF projects that this global total will treble between 2024 and 2030.

Courtesy of Datawrapper

Secondly, the tipping point for solar becoming cheaper than fossil fuels occurred only recently, and this calculation is for the power-generation companies, not consumers. Solar PV only reached cost parity in 2022 and became cheaper in 2023. Similarly, electrified systems that can make solar more attractive are also comparatively new, with EVs making up only 18 percent of new car sales in 2023. Meanwhilst, heat pumps remain the minority in markets where gas boilers are the standard.

But the gap between installations and production capacity, and the continued expense of contracting a home installation, clearly points to the key culprit: lack of skilled labour.

Estimates for the number of solar workers needed in the EU have soared. Whereas previously more than a million workers were anticipated to be required by 2030 across the complete solar supply chain within the bloc, those numbers have subsequently been blown out of the water. Employment was already estimated to have reached over 800.000 in 2023, and industry association SolarPower Europe forecast that a million workers will already be required by 2025.

In the US, the Bureau of Labor Statistics estimates that there were a paltry 25.000 PV installers across the country in 2023, and believes that number will rise 48 percent by 2033.

“We have found finding quality partners, skilled labour has been incredibly difficult,” says Atkinson, especially as many qualified electricians choose to “prioritise new-build solar rather than retrofit solar, so their skills can be monetised to a greater degree.”

This supply-demand imbalance has kept total installation costs high for consumers, especially as government subsidies in many jurisdictions became less generous in recent years.

UK government data found that the inflation-adjusted median for installing a 4-10 kW system was the highest ever in 2023-2024 (€1,9/kW), despite the decreasing cost of panels. Atkinson notes that even with growing economic and climate arguments for solar, they have “seen a continued decrease in demand since the war in Ukraine began.” He notes they “need suitable incentives for the customer on an enduring basis,” such as improved pricing for energy exports from individuals back to the grid or subsidies for installation, which were instrumental for driving heat pump adoption in European markets.

Once again, this likely means solar will be most transformative for the global south.

As noted previously, Afghan farmers were frequently able to rapidly install the equivalent of a large PV array for a western home in limited conditions and without specialised training. Lower barriers to installation and use, the need to generate millions of new jobs in many locations, and the high solar potential of these regions, means emerging economies are likely to see the biggest change.

India alone will need to create something like 100 million jobs between now and 2030, a rise that cannot be met without fully embracing sectors based around emerging technologies. The pattern repeats in Indonesia, where three million people enter the job market annually; Nigeria (four to five million); Ethiopia (two million) and other countries with youthful populations in the global south.

Atkinson believes the changing electricity consumption ecosystem in developed countries shall be much improved in the years ahead. “I'd say 2025 is a pivotal year for the marketplace,” he thinks, due to the potential for “a fully joined-up proposition for a customer … unlocking the whole home system,” for example a car battery powering the air source heat pump when solar generation is low, then reversing on sunny days. “It's wrapping them all together that that is the key.”

Change is coming

If there’s one thing to take away from all this, it’s that solar PV is now a case of adoption speed rather than a question of whether it will make a significant impact.

Falling costs of solar systems are meeting rapidly rising electricity demand, all at a time when we desperately need to cut emissions. The economics are especially sound for communities in dire need of reliable electricity, and that live in high solar-potential locations—e.g. the fastest growing, and largest, segment of the global population.

Improbably, today we can make twice as many PV solar modules than can be installed. That production will increase as countries besides China seek to secure their own solar supply chains. Simultaneously, the critical enabler of battery technology is only set to advance even as prices fall, and a handful of EV models can already act as potential massive batteries for homes.

These factors, combined with the aforementioned rapidly rising electricity demand, mean the trendline now heavily favours solar. Although there may be bumps on the road to widespread adoption, it cannot possibly relinquish its advantage to fossil fuels ever again.

This article by guest writer Alex Hadwick is part of "Overlooked: Technologies quietly changing the world," a series of pieces that focus on advances making tangible everyday differences, but that also promise transformative change.

04 Nov 2024

-

Alex Hadwick

Illustration by Thomas Travert.

02/03

Related Insights

03/03

L’Atelier is a data intelligence company based in Paris.

We use advanced machine learning and generative AI to identify emerging technologies and analyse their impact on countries, companies, and capital.