The futures of the metaverse

Facebook's rebranding as a metaverse company at the end of 2021 sparked a flood of memes, rumours, social commentary, and speculation.

Small businesses which L’Atelier BNP Paribas has followed for over two years suddenly catapulted into the global spotlight, seemingly overnight, due to a swell of interest in the metaverse from the public and investors.

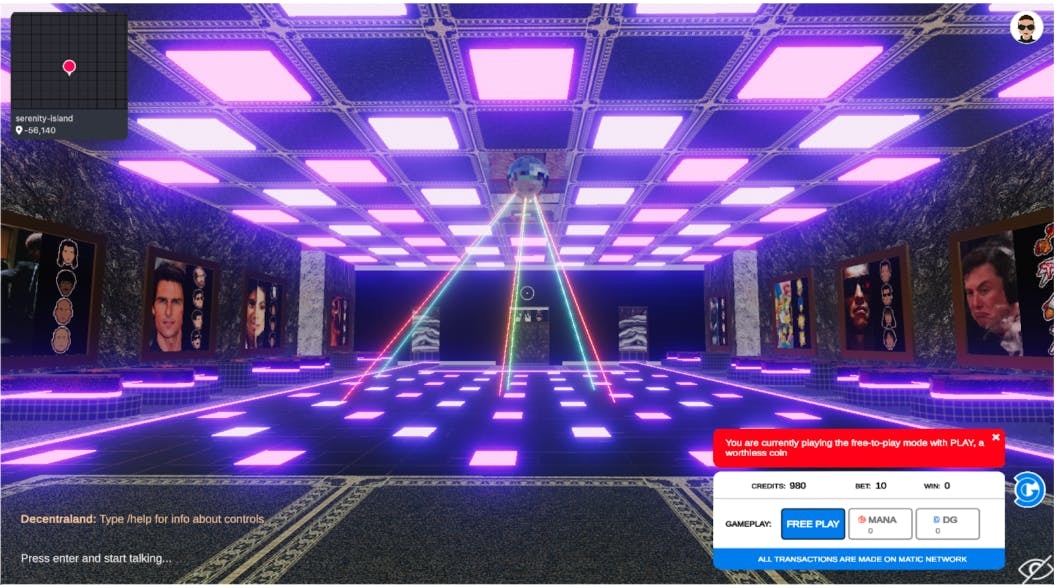

In January 2020, as part of my research on the virtual economy, I spoke with Ari Meilich, one of the founders of Decentraland. The company was launching a beta version of its game-like virtual world, and virtual real estate was fetching hundreds of dollars. I saw Decentraland for the first time with Meilich on the phone. Sparse buildings with glitchy art, an empty nightclub, and a cool dragon populated the mostly empty world.

I was eerily alone when I went there. I was equally fascinated.

The metaverse comprises a collection of virtual spaces that enable social connection. It includes markets for goods and services, along with entertainment and art. It is accessible through electronic devices such as computer browsers, phones, virtual reality headsets, and augmented reality glasses. Hypothetically, it could become a unified world that transcends physical and digital borders.

Consumer hardware that allows truly seamless access to semi-virtual worlds is currently unavailable. But it is rapidly developing.

Ubiquity necessitates accessibility. Users must be able to seamlessly transition from phones to laptops, gaming consoles, and virtual reality headsets. After that, the metaverse experience must adapt to 3D and 2D environments while maintaining immersion and usability. This is a difficult problem that has yet to be solved. When internet use shifted from the PC to the smartphone, technology companies faced similar challenges. While maintaining familiarity and comfort, services had to adapt to new screen formats, revenue generation models, and lower on-device processing power.

As a first step toward “metaversisation,” there is a large-scale rebranding of web-based platforms taking place. Roblox, for example, considers itself to be the "shepherd of the metaverse." Epic Games has expressed interest in tying Fortnite, Rocket League, and Fall Guys together.

Interoperability is crucial, and may help break down the barriers that currently exist between platforms and games. Game developers correctly observe that immersive spaces are often created using technology originally developed for gaming and other forms of entertainment. Interconnectivity between games is enabled by social elements integrated into existing popular platforms.

According to IDC, VR currently dominates the market of immersive hardware, with sales of headsets up 241,6 percent in Q1 2022, compared to the same period the year prior. Facebook's Oculus captured 75 percent of the headset market. When used correctly, virtual reality is truly amazing. Despite my hesitations, I became completely absorbed in conversations and games with strangers on AltspaceVR, now a Microsoft platform.

However, I was cut off from my real surroundings, and once the novelty wore off, VR began to feel like a time-consuming bad habit, rather than an enhancement of my day-to-day work and research. This was especially true when mild VR sickness set in after an hour or two, preventing me from transitioning smoothly onto a laptop.

I can't imagine sitting through a tense Monday morning meeting, let alone an entire workday, wearing a VR headset. Nevertheless, short bursts of VR in professional settings can be useful. I attended a brainstorming workshop, where virtual boards and directional audio helped structure conversation more smoothly. Because we couldn't use our phones or check emails at the same time, everyone seemed less distracted. VR in professional settings could be used for collaboration, sales and pitches, training and education, planning complex problems, design, and prototyping.

According to a Wool & Water survey of US consumers, 85 percent of Americans are "somewhat or very excited about AR," especially when it comes to shopping. We've all used augmented reality in our TikTok and Instagram filters, and brands increasingly cash in on the trend. Beauty brands frequently use AR filters on social apps to allow users to try products. While Google merges both AR and VR development environments, Apple has focused mainly on AR so far.

The main challenge is to move AR hardware adoption beyond phones and into wearables. AR relies on live video to function, and the failure of Google Glass demonstrated widespread societal apprehension about always-on cameras. Given a healthy app development ecosystem, any company that succeeds in creating camera-equipped AR glasses will likely dominate the market in no time. Apple has taken notes, and beta versions of software updates in 2019 revealed that the company may develop an AR device, likely to launch in 2023.

One way to create frictionless, seamless experiences is to tap into a user's thoughts. The final frontier of intimate immersion will be interacting with the metaverse directly, using our brain. It will necessitate reshaping our thoughts in order to interact with virtual environments, and will allow machines—and marketers—to know us better than we know ourselves.

Brain-machine interfaces are increasingly available outside the lab, allowing for new methods to engage with machines. Consumer goods that do not require brain implants, and can simply be placed on the temples to detect brain waves, are now on the market. Startups like NextMind and Kernel are already producing hardware, often coupled with development environments, hoping to capture market share before the tech behemoths arrive.

The metaverse will have to wrap itself around our senses and thoughts if it is to become a constant in our lives. There is little doubt that the hardware challenges will be overcome in the next five years; the question is whether we will accept it as part of our increasingly virtual realities.

08 Sep 2022

-

Giorgio Tarraf

The future in your inbox, once a week.

02/03

Related Insights

03/03

L’Atelier is a data intelligence company based in Paris.

We use advanced machine learning and generative AI to identify emerging technologies and analyse their impact on countries, companies, and capital.